Hey friends,

Here is your August Newsletter!!!

In the May Newsletter, we had an overview about what is the best way to invest in short-term markets during this recession time.

In this newsletter, I want to write about stocks (As always). You may ask then what’s new, of course, the whole market is reset now.

Have a look at these images.

📈 CSE History

CSE Performance as Maithripala Sirisena President

During this period there are no considerable changes in the stock market in Sri Lanka. Foreign investments are low, the market volume is moderate, and The overall ASPI return was near -21%

CSE Performance as Gotabaya Rajapaksa President.

During this period there was a bull run in many companies that performed well in the stock market in Sri Lanka. Foreign investments are attracted, the market volume is high, and The overall ASPI return was near +20%.

I don’t want to discuss the political aspect here but CSE attracted many investors and more turnovers ( I also get into the sock market somewhere around the 2020/2021 period). But when this unstable government created the 2022 economic crisis, the markets recorded a bear rally (The crash).

CSE Performance as Ranil Wickremesinghe President (Now)

Now the new government formed and the economy started to recover back, inflation starts to dilute and some positive news in the county. It created a good review about CSE among investors. As for this date, we recorded a +40% return within two months.

Well, now you may understand that the Stock market aligns with a country’s economy. Now have a clear look at this image.

CSE Performance since 1994

We can see that we are growing over time ever with the leadership because the stock market does not work based on Presidents. It works according to how companies perform well over time.

The Stock Market is not a gambling platform. It’s the platform that regulates the country’s economy with investors’ sentiments based on companies. From history, you can see these things.

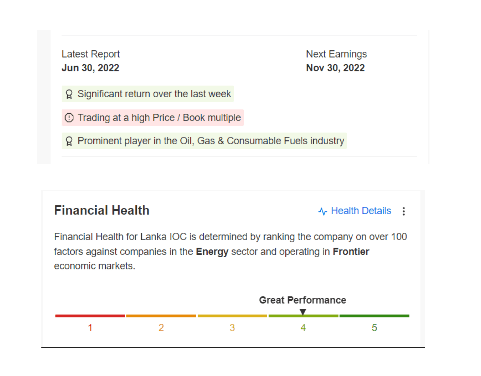

📊 Our Monthly Portfolio Update

From this newsletter onwards we would like to update our newsletter readers on our best-performing stock. But Clearly, this is not a buy-sell recommendation. We always rely based on the company’s fundaments and if something seems not promising we will switch companies which have more advantages. So always do your research before investing in these stocks.

| Company | Portfolio Change |

🙂So what next?

Instead of worrying about profits and losses focus on the fundaments of the company. If a company seems to be promising growth for the next 100 years, don’t worry whether it’s down by -50% in recession or not performing short-term very well.

I hope the Quote of the month from Legendary Investor Peter Lynch answers many questions related to stock volatility for investors.

Top Important Video!!!

✍️Quote of the Month

“I think you have to learn that there’s a company behind every stock and that there’s only one real reason why stocks go up. Companies go from doing poorly to doing well or small companies grow to large companies.” – Peter Lynch